19 jul Rooks Bookkeeping A Guide to Construction Bookkeeping for

Content

- Tip 8: Hire an accountant

- Bookkeeping Tips for Construction Businesses

- Construction SAGE Accounting Software (Sage 100 Contractor)

- “Make better business decisions with accurate job costing.”

- More Brand New Contractor QuickBooks Digital Products Available HERE!

- Why is Construction Bookkeeping different?

- Keep Your Records Safe

With our integrated comprehensive solutions for tax, accounting, payroll, and bookkeeping, we help small businesses streamline their financials, save money, & stay focused on growth. Our mission is to provide builders, developers, GCs, and specialty contractors the precision bookkeeping services they need to aggressively grow their businesses and their bottom lines. In this article, we’ve shared details on some construction bookkeeping of the most common and widely-used platforms in the construction industry. Of course, the software or platform you use for your business will vary depending on your budget, the complexity of your projects, the features you need, etc. Most of the platforms discussed above provide you with a free trial or free demo – in this way, you can determine which is the best bookkeeping platform for your business.

- We bill for the contractor according to the contractor’s request based on accuracy and promptness so that the contractor can receive the payment on time.

- You’re able to then compare vendors side-by-side to make the most educated decision.

- So, what are some key things to keep in mind when managing accounts for a construction company?

- This is best for contractors who want to integrate an accounting and project management platform with construction drawing and output.

- Let us fight for you and create a customized plan to reduce your tax burden and drive growth.

- Construction accounting software will help keep your team organized because it records financial transactions in one centralized location.

Weekly reports, monthly calls, customer service… They are a true partner. These business owners construct the world around us, yet remain terribly underserved when it comes to the resources needed to grow their businesses. Our mission is to arm them with the right financial tools to thrive for years to come. Companies that had client tracking, software integrations and mobile apps performed better than those that didn’t.

Tip 8: Hire an accountant

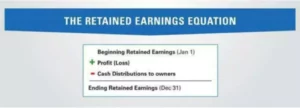

Especially since in the construction industry, there are multiple projects going on at once, it is important to track invoices so nothing gets lost. Many industries operate using billing processes like fixed-price and point-of-sale billing. However, since construction companies use a number of billing methods, specialized software might be required to track those billings. With the installment method, you only record revenue once you’ve received payment from the client. This means that you recognize income in the accounting period when it’s collected, and not at the time of sale.

When you’re running a landscaping business, it can be difficult to know where your team is throughout the day. Alternatively, you can take advantage of a dedicated bookkeeping software solution to manage your bookkeeping more easily. Alternatively, you can talk with other business owners and ask if they can recommend a certified accountant. If you decide to hire an accountant, look for one with experience in your industry because they’ll know how to handle your company’s accounting needs most effectively. The main reason for this is that bookkeeping isn’t a standardized service.

Bookkeeping Tips for Construction Businesses

The costs of rental equipment will need to be factored in, as well as the invoicing due for obtaining it. Companies that invest in their own equipment need to include the maintenance costs of that equipment in their overhead estimation. This will involve the costs of administrative staff such as controllers, schedulers and accountants, as well as the salaries of any foremen or employees. It includes rent or mortgage for the facility owned by the company, as well as maintenance for their equipment. This isn’t just for audits; errors happen, typos happen and things can get lost. Paper invoices and receipts can be filed or scanned; online paperwork can be screenshotted and saved.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images. The best way to account for this is to include this information on your invoices. To do this, include information on your milestone payment and the amount. Then include a second set of numbers that reflect the retainage value which should be shown as a credit.

Construction SAGE Accounting Software (Sage 100 Contractor)

Its unique ability when it comes to tracking costs, client details, and timelines of projects is what makes QuickBooks so popular among contractors. Yes, when conducting bookkeeping for construction, QuickBooks is very effective, efficient, and easy-to-use financial systems software that is used by many contractors in the construction industry. Good construction accountants are incredibly difficult to find, that’s why we put together our outsourced accounting service for commercial contractors & residential builders. The construction industry presents a particular challenge for bookkeepers due to highly complex accounting rules and tax regulations. Because of that, construction companies need a bookkeeper with industry experience.

One way to solve this problem is to use accounting software like QuickBooks Online because it automates the bookkeeping process. Our accounting team offers construction company bookkeeping services to contractors whenever needed. Foundation breaks its software down into modules that you can put into a custom solution.

“Make better business decisions with accurate job costing.”

Use calendars to track the billing and invoicing cycles so that neither are overlooked. This can be automated with most modern accounting software suites, but even a paper calendar will help. Construction contracts are normally paid out on a schedule, as the project progresses, with a portion of it held back until completion. Based on the contract, schedule accounts payable as needed so that no accounts go overdue.

A responsive accountant is someone who answers your questions and helps you in a timely manner. Outsourcing accounting involves hiring an external accounting firm or professional to manage financial tasks remotely. An outsourced accountant is a professional accountant or accounting firm that a company hires to complete various accounting tasks remotely. The most common tax form needed is Form 1099, which provides a record of the total payment made to the contractor in a tax year. Certainly, you can deduct website expenses on your taxes if they are necessary and ordinary business expenses.

More Brand New Contractor QuickBooks Digital Products Available HERE!

Dave Nevogt is an American entrepreneur and the co-founder of Hubstaff, a workforce management software company. He has earned a finance undergraduate degree, the Indianapolis Business Journal’s Forty Under 40 award, and Arizona’s 35 under 35 award. Opting for a solution that requires extensive training before you can use it is not only going to cost you time but also risk frustrating both you and your employees. Some solutions, like Hubstaff, offer a free trial to provide you with an opportunity to test the software and determine if it’s the right fit for your needs.

- This can look like keeping receipts, invoices, and order forms in organized and easily accessible places, either as physical documents or digital files on a company computer.

- Conduct an audit of a project that will build a report easy for your certified public accountant (CPA) to digest and work from.

- The next function layer is the Procore analytics feature that works with the specialized app marketplace filled with third-party solutions that integrate with Procore.

- Starting your own landscaping business requires some basic equipment, knowledge, and most importantly passion.

Her work has appeared on Business.com, Business News Daily, FitSmallBusiness.com, CentsibleMoney.com, and Kin Insurance. This software is best for contractors who have multiple projects happening simultaneously. This software is best for those who manage construction projects on real estate that they own or lease.